Cquickbooks creating invoices and estimates code#

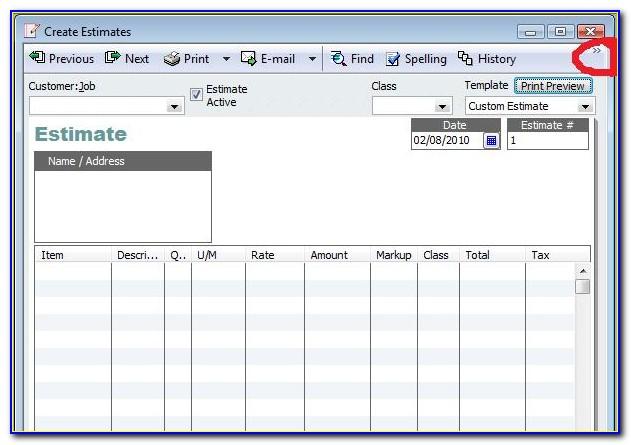

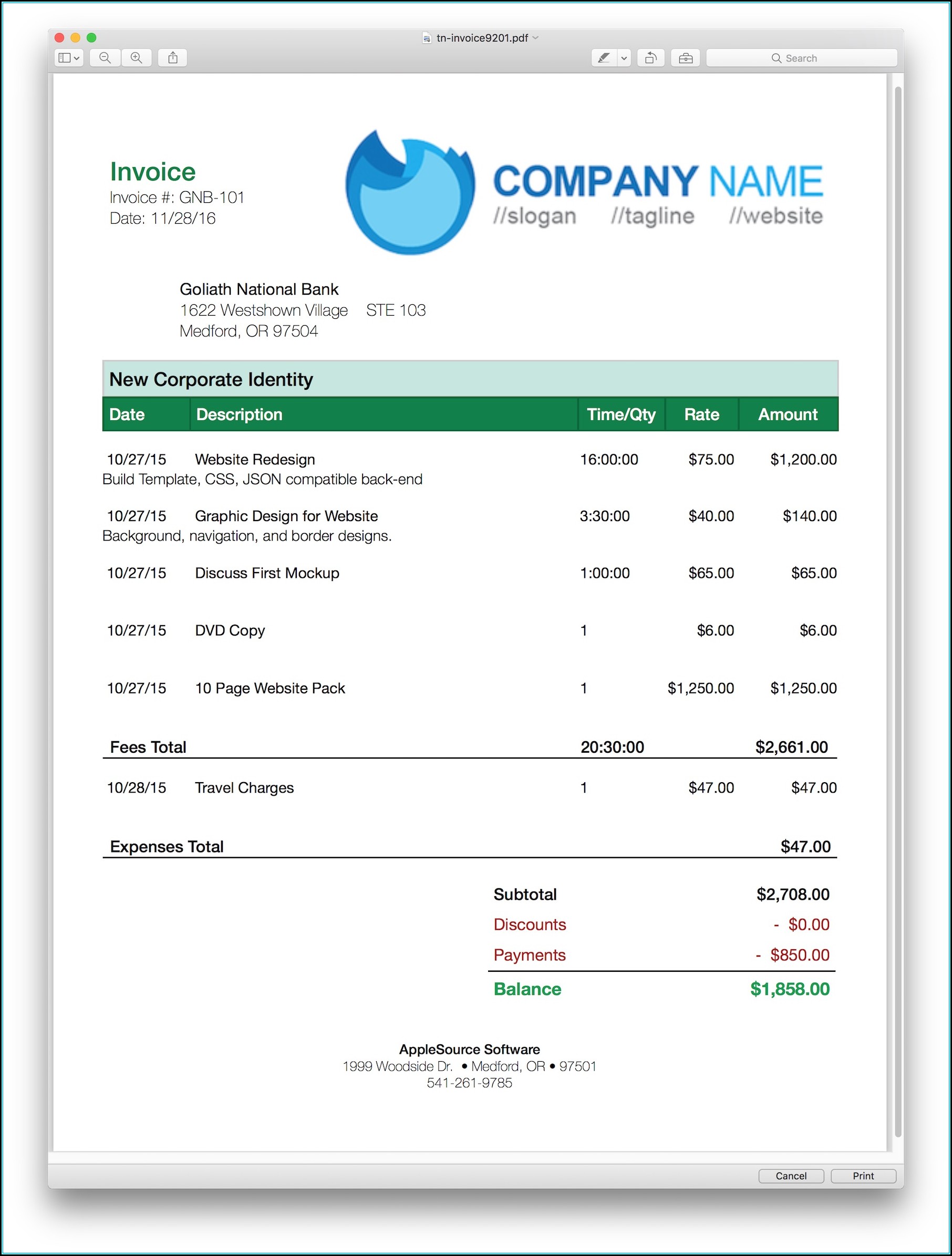

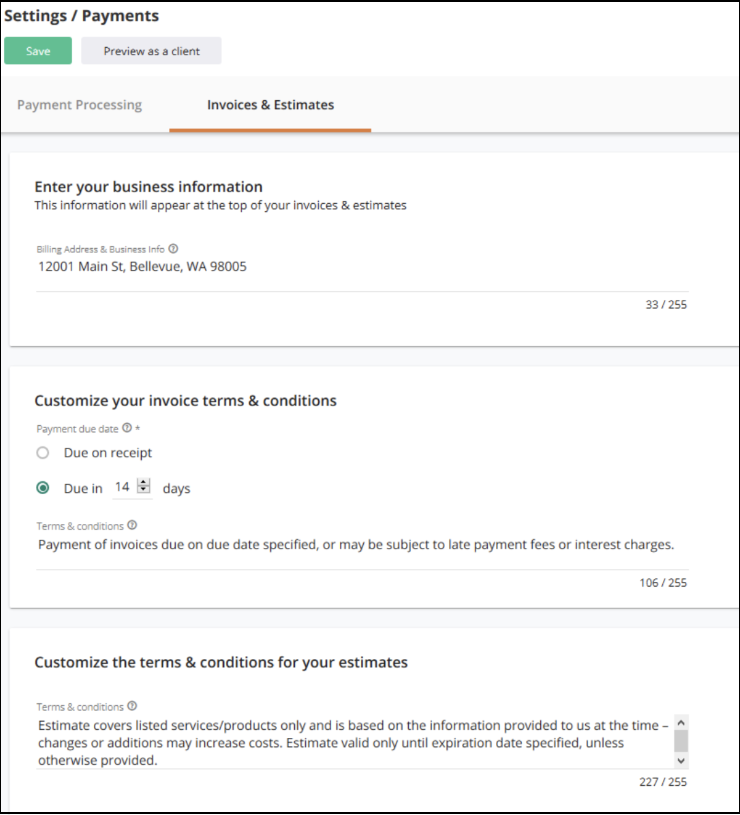

You will have to choose an appropriate tax code for the item.Select the income account to be used to track discounts from the account drop-down.In case the discount amount varies, you will have to leave the amount or percent field blank and then enter the amount directly on the sales forms. In the amount or % field, you need to enter the discount amount or percentage.Furthermore, you would have to enter the item name/number and a brief description.Choose the type drop down and then select discount.You need to now right click anywhere, followed by selecting new.You need to move to the list menu form the home screen.This step is not mandatory, as if you wish to apply for a discount, you will have to create a discount item.You can also delete or modify this while creating invoices. It should be noted that the when you choose or adds an item, the description and amount are populated based on the description and unit cost entered when it was set up that too on its own. Followed by filling in the relevant information at the top of the form such as the date invoice #, Bill to/Sold to, and terms.In case the customer or job is not on the list yet, you can select the add new option. From the customer job drop-down, you need to select the customer or customer job.Select create invoices from the home screen or the customers menu.Steps for Creating an invoice from scratch in QuickBooksįor the ones who do not require creating sales orders or estimates, then A/R workflow begins from creating the invoice. Simple tax filing, recording all sale invoices guarantees the right amount being paid.Legal safety, as it acts as a legal proof.Payment tracking on both seller and buyer’s end.There is a huge list of benefits of creating invoices in QuickBooks. How beneficial is crafting invoices in QuickBooks? One important thing that people should take into consideration is to ensure having all the required details to create invoices before beginning the process. It updates financial statements in real-time.

Easily sending email invoices to customers directly from QuickBooks.There is a wide range of benefits to creating invoices in QuickBooks. You may also like: Steps to Fix Error: QuickBooks unable to create accountant’s copy Why you should create invoices in QuickBooks Desktop? This depends upon the type of the transaction made with the client. There are different ways in which an invoice can be created on QuickBooks. The invoice is used for recording the sales transactions from customers that haven’t made the payment upfront or had made partial payments. Invoice creation is a part of the routine accounts receivable workflow in QuickBooks. It is basically an asset for the seller and a liability to the buyer. Whereas, if you aren’t interested in investing your time in performing the process manually or if you want our tech geeks to assist you, then link up with our QuickBooks support team using our dedicated support line i.e., 1-80. Thus, make sure to stay connected to this piece of writing till the end. In this blog post, we are going to discuss the process in detail. You might generally look for the process to create invoice in QuickBooks, as it might invoice certain steps. The QuickBooks desktop has a feature to create invoice and also the document given to the buyer to collect the payment, which makes QuickBooks one of the most compelling accounting software. In simple words, you can manage the account receivables with the help of invoices. Invoices are basically used to record sales transactions from customers who make no or partial payment at the time of sale. Saving money and simplifying the process of invoicing is possible with the help of QuickBooks. The businesses and entrepreneurs are required to manage their cash flows in the most appropriate manner.

Crafting an invoice is one of the essential or key document required to be developed for a business. Hunting for ways to create an invoice in QuickBooks desktop? Well, if yes, then you have landed on the right place. Learn the process of creating invoices in QuickBooks desktop and online: Steps To Create Invoice For The First Time In QuickBooks Online.Steps for Creating invoice for an Estimate.Steps to Creating invoice for sales order.Steps for Creating an invoice from scratch in QuickBooks.How beneficial is crafting invoices in QuickBooks?.Why you should create invoices in QuickBooks Desktop?.

0 kommentar(er)

0 kommentar(er)